How to Be a Successful Mutual in Today’s Environment

By Brett Daniels, Vice President of Reinsurance

It’s not an easy task for mutual managers to keep up with the rapidly changing insurance landscape. Inflation is a major concern in our industry and has the attention of all reinsurers. With construction and reconstruction costs running hot on building materials, plus a contractor shortage, it is difficult to keep up.

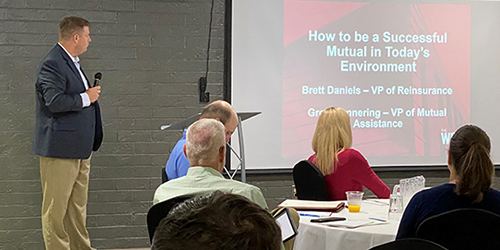

During WRC’s recent All Manager Meeting in Lake Geneva, WRC Vice President of Reinsurance Brett Daniels and Vice President of Mutual Assistance Greg Gonnering highlighted a few action items for our mutual managers to focus on.

One such action item was conducting annual rate reviews. These are crucial to the success of any insurance carrier. Developing a regular cadence of annual rate increases on a mutual’s book of business is necessary and healthy for the bottom line.

Greg and Brett also discussed policyholder deductibles. Deductibles have been a source of multiple discussions for years in our industry, but it’s time to move ahead and implement the $1,000/$2,500 combination deductible or move to a minimum $2,500 deductible if the combination deductible is not available through your software system.

As mentioned earlier, keeping up with inflation is difficult. WRC is emphasizing the importance of running ITV estimators annually to all mutuals, as structure costs are rapidly increasing. Running a new calculation each renewal cycle seems to be the only way to keep up with soaring inflation.

Successful mutuals have a robust inspection program. Obtaining multiple photos from different angles as well as closeups on the roofs is important. Focusing on not only the home but also other structures on the property is crucial for assigning the proper restrictive endorsements on a policy. Solid fuel burning devices should be identified by the inspector based on the exterior photos. It’s also necessary to obtain interior photos of the solid fuel device from the homeowner or agents showing clearance on each side.

Periodic reviews of the mutual underwriting manual and claims procedures are an important step in maintaining a healthy mutual. If you need any help, reach out to WRC. We have the expertise and capacity to assist in building and maintaining proper underwriting and claims manuals.

You can find the presentation slides by logging in to the secure WRC website and going to Documents > Operational Assistance > All Manager Meeting Materials > 2022 All Manager Meeting.